What's New

Updated Tax Schedule to 2024 and fixed issue with calculating higher figures

About GH PAYE - Tax VAT Calculator Android App

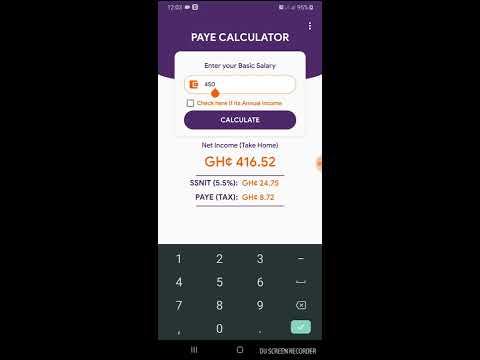

Ghana PAYE Calculator calculates your Income Tax based on your Salary and SSNIT Contribution (5.5%), and gives you an accurate representation of what you are to pay. This part is useful for everybody. The User Interface is neatly design and easy to use.

DISCLAIMER: We are in no way affiliated to Ghana Revenue Authority (GRA) or Social Security and National Insurance Trust (SSNIT).

This app was built with the latest information from GRA and SSNIT.

Sources of informations:

Tools: https://gra.gov.gh/online-tools/

PAYE: https://gra.gov.gh/domestic-tax/tax-types/paye/

SSNIT: https://www.ssnit.org.gh/faq/ssnit-nia-merger/

Ghana.Gov: https://www.ghana.gov.gh/

Income Tax Amendement Act: https://gra.gov.gh/wp-content/uploads/2022/01/Income-Tax-amendment-No-2-Act-2021-Act-1071.pdf

If you are a student or a lecturer, employer or employee or just an ordinary citizen interested in knowing how much your SSNIT Contribution or Income Tax Deduction (PAYE) is calculated and how much you ought to pay, this application will put you in the right direction.

Features:

1. Quick Calculations on Basic Salary

2. Detailed Calculations for payroll

3. Custom Tax schedule (Includes previous tax schedules)

4. Easy to use interface

5. Calculates VAT on goods and services (VAT, VAT Reversal, and VAT Flat Rate)

6. Calculates Net to Gross Salary and Gross to Net

7. Overtime tax, Bonus Tax, Tier 1, Tier2 and Tier 3 Calculations

And many more

Other Information:

Download

This version of GH PAYE Android App comes with one universal variant which will work on all the Android devices.

All Versions

If you are looking to download other versions of GH PAYE Android App, We have 1 version in our database. Please select one of them below to download.